- The Real Estate Companies that Danpulo’s Family Created in South Africa, and the Shareholders

- The Mortgage Bonds that Danpullo Signed, Mortgaging all his Companies for Loans Obtained from FirstRand Bank

- Details of the Loans and the Terms of the Agreement that Danpullo himself Signed with the Bank

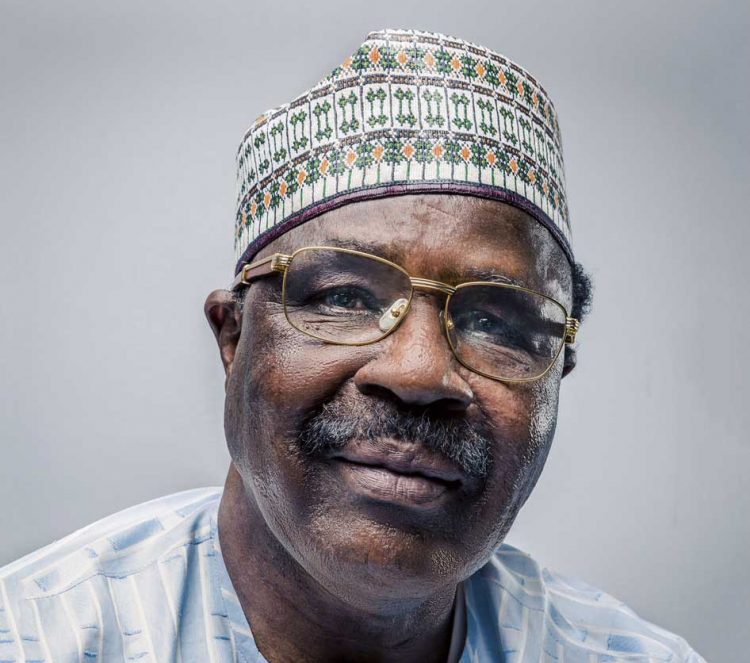

From what THE MENTOR has been able to gather so far as regard what happened that the companies of Cameroonian businessman, Ahmadou Baba Danpullo, in South Africa were placed on liquidation in 2020, it should first of all be noted that before 2020 he had been doing business in MADIBA’s great country for over 30 years.

As Baba Danpullo himself put it, his companies were real estate investment companies “focused mainly on investment opportunities in the commercial and residential property market”. They were all real estate companies, and were doing business in three cities in South Africa, namely Cape Town, Port Elizabeth and Johannesburg fondly known as Joburg.

Bestinver Company South Africa Propriety Limited

Over the years, Baba Danpullo’s businesses in South Africa grew into three companies, which were all registered as limited liability companies. The companies were Leopont 193 (Pty) Limited, BestinverPop 01 (Pty ) Limited, and Joburg Skyscrapper (Pty) Limited. Bestinver Company South Africa Propriety Limited was created to run the three other companies. All the three companies thus became the affiliates of Bestinver Company. In order words, Bestinver Company South Africa Propriety Limited , or better still Bstinver Group as Baba Danpullo often called it, was the mother company of Leopont 193 (Pty) Ltd, BesinverProp 01 (Pty) Ltd and Joburg Skyscraper (Pty) Limited.

In this story which is in three parts, THE MENTOR will most of the time call the Bestinver Company South Africa Propriety Limited as Bestinver Group for clarity, considering also that one of the affiliates, Bestiinver Prop 01 (Pty) Limited, has a similar name.

10 Shareholders Of The Bestinver Group

On paper, Bestinver Company South Africa Propriety Limited had 10 shareholders, who were the following: 1) Yasmina Baba. 2) Ahmadou Bab. 3) Lantana Baba. 4) Ahmadou Baba Danpullo. 5) Houssene Baba. 6) Maimouna Baba. 7) Animatou Baba. 8) Zayd Baba. 9) Hassan Baba. 10) Moussa Danpullo Baba. From the look of things it was a family business of Ahmadou Baba Danpullo and his children or with his children and some other family members.

On paper, each of the 10 shareholders had a 10 % of the shares of Bestinver Group. Ahmadou Baba Danpullo was the Board Chair, while Moussa Danpollo Baba was the Managing Director of Bestinver Group.

Ahmadou Baba Danpullo’s AFFIDAVIT ON OATH

Meanwhile, as regard the loans that Bestinver Company South Africa Propriety Ltd obtained from FirstRand Bank Ltd that ended up landing the Group into trouble because of several defaults to repay the loans, it should be noted that the Actual Summary And Background, are among other things contained in a 20 page affidavit that Ahmadou Baba Danpullo declared on oath. He presented the declarations himself and signed in front of the Commissioner of Oaths, at the High Court of South Africa, Gauteing Local Division, Johannesburg, on December 8, 2020. The Commissioner of Oaths was Andle Seth. The 20 page sworn affidavit was comprised of 66 points and several sub-points.

It should be noted that an Affidavit on Oath obliges one be honest in what he says, because it is a serious crime to say something on oath and it is proven to be a lie (lie on oath). In our courts judges often ask especially persons who come up to testify in matters, if they want to testify on oath or not. In country where the law is taken seriously, the penalty for lying on oath is imprisonment, not a fine.

Baba Danpullo Presented Himself As Shareholder

Meanwhile, the matter which came up at the High Court in Johannesburg on December 8, 2020, was a matter between The Shareholders of Bestinver Company South Africa Propriety Limited (Registration number 1994/009380/07)0 as Applicant, and Bestinver Company South Africa Propriety Limited in Liquidation (Registration number 1994 /009380/07) as First Respondent, with FirstRand Bank Limited as Second Respondent, and SECHARA Trust as Third Respondent.

The FOUNDING AFFIDAVIT opened with the statement: “I, the undersigned, AHMADOU BABA DANPULLO, hereby make and declare as follows:” Danpullo presented himself as: “I am an adult male person and the shareholder of the First Respondent, Bestinver Company South Africa Propriety Limited in liquidation”. The declarations starts from Point 1 to 66, with several sub-points, the end of which he signed as Despondent, and the Commissioner of Oaths also signed.

Loans Bestinver Group Obtained From FirstRand Bank

It is stated in Point No. 11 in Baba Danpullo’s Affiavit, that: “On 19 August, 2016, at Cape Town, Ahmadou Baba Dnpullo, acting on behalf of the First Respondent, and the Second Respondent entered into a written loan agreement (loan agreement A) in terms of which the First Respondent was afforded credit facility in the sum of R 210 million by the Second Respondent”. Point No. 13.2 stated that: “The First Respondent would repay the loan over a period of 120 months”.

Point No. 13.3 “The monthly repayment installment would be R 3, 179.65 in respect of Month 1 to Month 60, and R 1,942,617.83 in respect of Month 60 to 120”. Point 13.4 “Interest would be calculated at Prime .50%”. Worth noting that South Africa’s currency is known as rand, and so R 20 for example means 20 rand.

Security Guarantees For The Loan

Meanwhile, as regard the security guarantee for the loan, Point 14 in the affidavit stated that: “The following security would inter alia be provided by the First Respondent (Bestinver Group) to the Second Respondent (FirstRand Bank)”. Point 14.1 names the security guarantees: “Cross –Sureties, Johannesburg Skyscraper and Leopont Limited to R 350 million”. 14.2 “A Mortgage Bond registered by the First Respondent over a property located in Princess Location in Pretoria in the amount of R 150 million”. 14.3 “A Mortgage Bond registered by Joburg Skyscraper over ERF 8757, Walmer, Eastern Cape in the amount of R 120 million”.

14.4 “A Mortgage Bond registered by the First Respondent over Erf 141646, Cape Town , Western Cape in the amount of R 120 million”. 14.5 “A Mortgage Bond registered by Leopont over 117068, Cape Town in Western Cape, in the amount of R 30 million”. 14.6 “A Notarial Deed registered under K 1235 /1994 in respect of ErF 141644 Cape Town, Western Cape in the amount of R 30 million, and” Point 14.7 “Leopont and Joburg Skyscraper and companies with our Group of companies “.

What Was To Happen In Case Of A Default

Furthermore more, Ahmadou Baba Danpullo in Point No. 15 in the Affidavit further declared the following undertakings to the Second Respondent that is FIRSTRAND Bank, on behalf of the First Respondent, that Bestinver Group. Point No. 15. 1 “I would on request furnish the Second Respondent with signed and audited financial statements as soon as they are available”. Point 15.3 “I may if I become aware of any occurrence of any circumstance which may result in a default or potential event of default forthwith, advise the second Respondent in writing “.

Readers should take particular note of what Point No. 16, Point No. 16.1 and Point No. 16.2 says as was agreed by Ahmadou Baba Danpullo on behalf of the First Respondent (Bestinver Company South Africa Propriety Limited) and the Second Respondent (FirstRand Bank Limited), as to what would happen in case of a default on the repayment of the loan by installments. Take note that Point No 16 does not end, as it connects to Point No. 16.1.

Point No. 16: “Upon the occurrence of an event of default or potential default, the Second Respondent would in addition to and without prejudice to any other rights it may have in terms of loan agreement A or in Law, have the right upon notice to immediately, (Point 16. 1) Accelerate and or place on demand, payment of loan outstanding which shall become due and payable, and (16.2) CALL UP AND EXECUTE ANY SURETY DOCUMENT”.

Conditions To Be Granted A Loan

Worth noting that banks do not invite people or companies to come and get loans. If you go to a bank to ask for a loan, and the bank gives you its terms or conditions for the loan, it is for you to accept or leave it. You are under no obligation to accept the terms. But if you accept the terms set by the bank, and then sign the agreement and obtain the loan, you should bear in mind that you have an obligation to respect the terms of the agreement. You cannot after collecting and spending the money start complaining that the conditions for the loan were too tough, as if the bank forced you to accept. That is being dishonest and irresponsible.

Another Loan Package From FirstRand Bank

Meanwhile, the loan agreement was signed between the First Respondent (Bestinver Group) and the Second Respondent (FirstRand Bank) on August 19, 2016, was not the first time that the latter granted a loan to the former. In fact Bestinver Group had being a client of FirstRand Bank for a number of years before, though it would appear that the loans that the former used to demand from the latter were comparatively smaller. But it was because of that existing relationship that FirstRand Bank in the first place accepted to grant the big loan to Bestinver Group.

Meanwhile in 2017, Bestinver Group went to FirstRand Bank to ask for another loan package. Point No. 21 of the declarations that Ahmadou Baba Danpullo made in the Affidavit on Oath, disclosed that on October 11, 2017, Bestinver Group and FIRSTRAND Bank signed another written loan agreement (loan agreement CI) in terms of which the bank granted the Group’s affiliate, BestinverProp01 (Pty) Ltd, a credit facility in the amount of R 260 million, to be given in two installments (Part A for R 160 million, and Part B for R 100 million). Baba Danpullo on behalf of Bestinver Company also signed a number of mortgage bonds registered for the loan.

By mortgaging BestinverProp for the loan obtained in 2017, Baba Danpullo had mortgaged all the three companies that were owned by Bestinver Company South Africa Propriety Limited, for the two loans obtained by in 2016 and 2017 from FirstRand Bank Limited. Bestinver Group also took an overdraft of R 5 million from FirstRand.

By Joe Dinga Pefok (Uncle Joe)

Facebook: The Mentor

Email: djpefok@yahoo,com

Contacts – Telephone / WhatsApp: (237) 677 17 54 51 / 699 71 83 92

80 comments

buy balloons with delivery Dubai buy helium balloons with delivery Dubai

Конструкторы оружия России https://guns.org.ru история создания легендарного оружия, биографии инженеров, технические характеристики разработок.

A round of applause for your article. Great.

people’s pharmacy online pharmacy canada pharmacy discount card

Hi, I do believe this is an excellent blog. I stumbledupon it 😉 I will return once again since i have book-marked it.Money and freedom is the greatest way to change,may you be rich and continue to guide others.

I appreciate you sharing this blog.Thanks Again.

Major thanks for the blog.Really looking forward to read more. Great.

Great post.Really looking forward to read more. Want more.

Im obliged for the post.Really thank you! Will read on…

Enjoyed every bit of your article post. Really Cool.

excellent issues altogether, you simply gained a new reader.What would you recommend in regards to your postthat you made a few days in the past? Any certain?

All the latest gaming information, recreation critiques and trailers A one-stop store for all things video games.Spider-Man No Way Home full movie

Really informative article post.Really thank you! Cool.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several emails with the same comment.Is there any way you can remove people from that service?Thank you!

That is a great tip particularly to those new to the blogosphere. Brief but very accurate information… Thanks for sharing this one. A must read post.

I believe you have remarked some very interesting points, regards for the post.

Please wait ocuflox rxlist The Department for Environment, Food and Rural Affairs (DEFRA)says you should contact them if you find a dead wild swan, or agroup of dead birds in a small area by phoning their hotline on0845 9335577.

VegasBetting lists odds for extra than 20 sports and the betting lines are frequently updated.

Just wanna tell that this is very beneficial, Thanks for taking your time to write this.

Hi there friends, pleasant paragraph and nice arguments commentedhere, I am really enjoying by these.

A motivating discussion is worth comment. There’s no doubt that that you need to publish more on this topic, it may not be a taboo matter but generally people don’t discuss these issues. To the next! All the best!!

What’s up, of course this article is truly nice and Ihave learned lot of things from it on the topic of blogging.thanks.

Aw, this was an exceptionally good post. Finding the time and actual effort to create a very good article… but what can I say… I put things off a lot and never manage to get nearly anything done.

Generally I don’t read post on blogs, but I would liketo say that this write-up very compelled meto take a look at and do so! Your writing style has been amazed me.Thank you, very great post.

Ya sea joven o sabia, rubia o pelirroja, encargada del hogar o mujer de negocios, puede conocer a la chica de sus suenos en Internet.{citas con mujeres

597884 532853I like this post extremely much. I will undoubtedly be back. Hope that I can go by means of far more insightful posts then. Will likely be sharing your wisdom with all of my buddies! 804756

A fascinating discussion is worth comment. I think that you should write more on this issue, it might not be a taboo subject but typically people don’t speak about such issues. To the next! All the best!!

Wow that was strange. I just wrote an really long comment butafter I clicked submit my comment didn’t appear.Grrrr… well I’m not writing all that over again. Regardless, justwanted to say wonderful blog!

I love looking through an article that can make people think. Also, thanks for permitting me to comment!

Usually I don’t read article on blogs, but I wish to say that thiswrite-up very pressured me to check out and do so! Your writingstyle has been surprised me. Thank you, quite nice post.

Regards for helping out, wonderful info. “Job dissatisfaction is the number one factor in whether you survive your first heart attack.” by Anthony Robbins.

Hey! I’m at work surfing around your blog from my new iphone! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the great work!

Thanks – Enjoyed this post, how can I make is so that I receive an email sent to me every time there is a fresh post?

Sweet blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Cheers

Youre so cool! I dont suppose Ive read something like this before. So good to seek out any person with some authentic ideas on this subject. realy thanks for beginning this up. this website is one thing that’s needed on the internet, somebody with a bit originality. useful job for bringing one thing new to the web!

I’ve been absent for some time, but now I remember why I used to love this blog. Thank you, I’ll try and check back more frequently. How frequently you update your web site?

Hello there! Do you use Twitter? I’d like to follow you if that would be okay. I’m undoubtedly enjoying your blog and look forward to new updates.

I’m not positive where you’re getting your info, but great topic. I must spend a while finding out more or working out more. Thank you for excellent information I was in search of this info for my mission.

F*ckin’ remarkable issues here. I am very glad to peer your article. Thank you a lot and i am having a look forward to contact you. Will you kindly drop me a e-mail?

I’m not sure where you are getting your information, but good topic. I needs to spend some time learning much more or understanding more. Thanks for magnificent information I was looking for this info for my mission.

I haven’t checked in here for some time as I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

Hi, i believe that i noticed you visited my weblog thus i came to “go back the choose”.I am attempting to find issues to improve my website!I suppose its good enough to use a few of your ideas!!

Hello there! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in exchanging links or maybe guest authoring a blog article or vice-versa? My site discusses a lot of the same subjects as yours and I think we could greatly benefit from each other. If you might be interested feel free to send me an e-mail. I look forward to hearing from you! Awesome blog by the way!

whoah this blog is excellent i love reading your posts. Keep up the great work! You know, lots of people are hunting around for this information, you can help them greatly.

excellent issues altogether, you simply gained a brand new reader.What may you suggest in regards to your post that you just made some days in thepast? Any positive?

fantastic issues altogether, you simply gained a logo new reader. What may you recommend in regards to your submit that you made a few days in the past? Any sure?

Pretty! This has become a very superb post. Many thanks for giving this info.

Howdy! Do you use Twitter? I’d like to followyou if that would be okay. I’m absolutely enjoyingyour blog and look forward to new updates.Also visit my blog post … spyep.com

Very good blog.Thanks Again. Really Great.

Hi there, after reading this remarkable article i am also delighted to share my knowledge here with friends.

Thanks , I’ve just been looking for information approximately this topic for ages and yours is the greatest I have found out so far. However, what concerning the bottom line? Are you sure concerning the source?

I really like your article. It’s like you read my thoughts! I enjoyed reading what you had to say. Great post!

Hi there, I enjoy reading through your article. I wanted to write alittle comment to support you.

It’s nearly impossible to find well-informed people for this subject,but you seem like you know what you’re talking about!Thanks

I like reading an article that will make men and women think. Also, many thanks for allowing for me to comment!

Thanks-a-mundo for the blog.Really looking forward to read more. Keep writing.

I needed to thank you for this wonderful read!! I certainly loved every little bit of it. I have you saved as a favorite to look at new things you postÖ

No matter if some one searches for his required thing,thus he/she wishes to be available that in detail, thus that thing is maintained over here.

I value the blog.Really looking forward to read more. Really Great.

fantastic put up, very informative. I ponder why the other experts of this sector don’t understand this.You must proceed your writing. I’m confident, you’ve a great readers’ basealready!

I think this is a real great article.Really thank you!

Hey there! I simply wish to offer you a big thumbs up for your excellent information you have right here on this post. I’ll be returning to your blog for more soon.

Really enjoyed this blog article.Really thank you!

A motivating discussion is definitely worth comment. I do think that you should publish more on this subject, it might not be a taboo subject but typically people don’t speak about these topics. To the next! Best wishes.

I need to to thank you for this fantastic read!! I certainly loved every bit of it. I have got you saved as a favorite to look at new stuff you postÖ

This blog was… how do I say it? Relevant!! Finally I have found something which helped me. Kudos.

A round of applause for your article post.Thanks Again. Really Cool.

Thank you ever so for you blog post.Much thanks again.

Usually I don at read article on blogs, however I wish to say that this write-up very forced me to take a look at and do so! Your writing style has been surprised me. Thanks, quite nice post.

Great, thanks for sharing this article post.Really looking forward to read more. Want more.

Awesome post.Really looking forward to read more. Great.

Say, you got a nice post. Fantastic.

This blog was how do you say it? Relevant!! Finally I ave found something which helped me. Cheers!

Generally I don’t learn article on blogs, but I would like to say that this write-up very pressured me to check out and do so!Your writing taste has been amazed me. Thanks, quite nicepost.Here is my blog post :: hemp farming

Greetings! Very helpful advice in this particular post! It’s the little changes that produce the most significant changes.Thanks for sharing!

You have very nice post and pictures, please have a look at our photo tours in the temples of Angkorlinklist.bio

Good post but I was wanting to know if you could writea litte more on this subject? I’d be very thankful if you couldelaborate a little bit more. Kudos!

I enjoy looking through a post that can make people think.Also, thanks for allowing me to comment!

buying drugs from canada

https://expresscanadapharm.com/# Express Canada Pharm

pharmacy wholesalers canada

I appreciate you sharing this article post.Really thank you! Fantastic.